Prepare the First Two Years of a Straight-line Amortization Table.

Prepare the first two years of an amortization table using the straight-line method. Up to 24 cash back Prepare the first two years of an amortization table using the straight-line method In our discussion of long-term debt depreciation we will look at both bonds before.

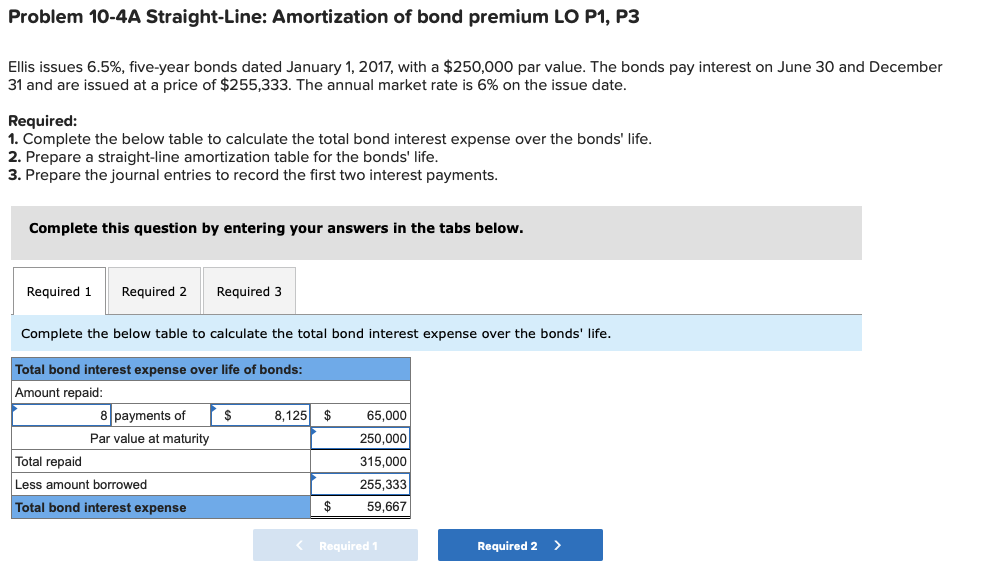

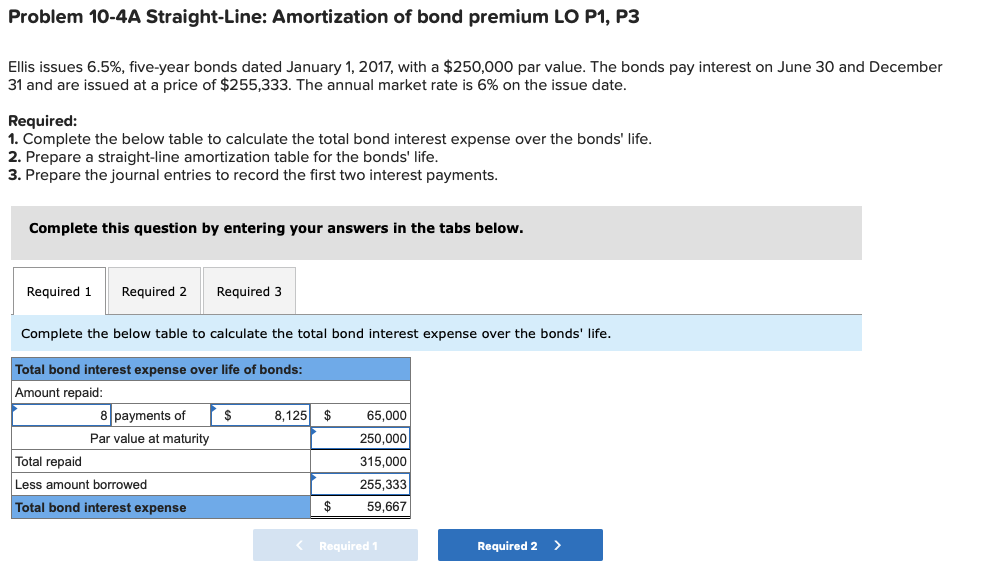

Solved Problem 10 4a Straight Line Amortization Of Bond Chegg Com

Prepare a straight-line amortization table for the bonds first two years.

. Prepare the first two years of an amortization table like Exhibit 147 using the straight-line method. Heathrow issues 2400000 of 9 15-year bonds dated January 1 2011 that pay interest semiannually on June 30 and December 31. For each semiannual period compute a the cash payment b the straight-line discount amortization and c the bond interest expense.

V Question 3. And c the second interest payment on. Prepare the first two years of an amortization.

B The straight-line discount amortization c The bond interest expense. Determine the total bond interest. Prepare the journal entries to record the first two interest payments.

Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment. B the first interest payment on June 30 2015. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

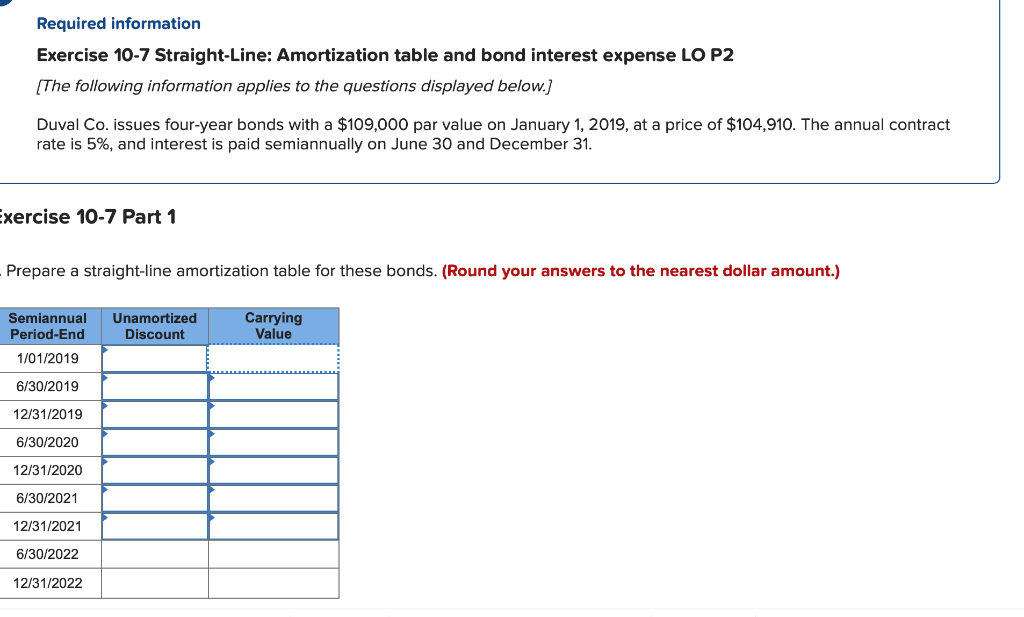

-1 -1 -2 -2 -3 -3 -4 -4 Semiannual Period-End Unamortized Discount Carrying Value 01012019 47690. Determine the total bond interest expense to be recognized over the bonds life. Prepare journal entries to record a the issuance of bonds on January 1 2015.

Check 3 4143552 4 12312014 carrying4. Prepare the first two years of an amortization table using the straight-line method. Round your intermediate calculations and final answers to the nearest dollar amount.

Prepare the first two years of an amortization table using the straight-line. Prepare the first two years of an amortization table using the straight-line method. As the 2 year semi-annual bond has 4 payment periods using the straight line bond amortization method the premium is simply amortized at the rate of 2204 4 551 each.

Omit the sign in. Complete the below table to calculate the total bond interest expense to be recognized over the bonds life. Complete the below table to calculate the total bond interest expense to be recognized over the bonds life5.

Prepare the journal entries to record the first two interest payments. Prepare the first two years of an amortization table using the straight-line method with these dates for a unamoritized discount and a carrying Value. Prepare the January 1 journal entry to record the bonds issuance.

Req 3 Req 5 Req 1 Req 2A to 2C Req 3 Req 4 Req 5 - 1 - 1. The bonds are issued at a price of. Complete the below table to calculate the total bond interest expense to be recognized over the bonds life.

Determine the total bond interest expense to be recognized over the bonds life. Prepare the first two years of a straight-line amortization table. Prepare the journal entries to record the first two interest payments.

Prepare the first two years of a straight-line amortization table. Prepare an effective interest amortization table like the one in Exhibit 14B1 for the bonds first two years. Prepare the first two years of an amortization table using the.

Round your final answers to the nearest whole dollar amount.

What Are The Difference Between Annual Straight Line Amortization Vs Effective Interest Amortization The Motley Fool

Solved Required Information Exercise 10 7 Straight Line Chegg Com

How To Create Even Payment And Straight Line Amortization Tables In Excel Exceluser Com

Comments

Post a Comment